19+ mortgage write off

Our Guided Questionnaire Will Help You Personalize Your Legal Form in Minutes. The first is that you must itemize your taxes and that means not taking the.

Langley Times February 19 2016 By Black Press Media Group Issuu

Web There are a few stipulations you must meet to write off your mortgage interest on your taxes.

. Your mortgage lender sends you a Form. Web A tax write-off which is the same thing as a tax deduction is a cost you can fully or partially deduct from your taxable income to lower the amount of taxes you owe. Ad Document Your Mortgage Loan Has Been Repaid with Our Satisfaction of Mortgage Form.

Unrestricted Deduction for Home Equity Loan Interest. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Ad Chat Online Right Now with a Tax Expert and Get Info About Tax-Deductible Donations.

Look in your mailbox for Form 1098. On Thursday the 30-year fixed mortgage rate hit 71 according to the latest data. Mortgage Interest The interest you pay for your mortgage can be deducted.

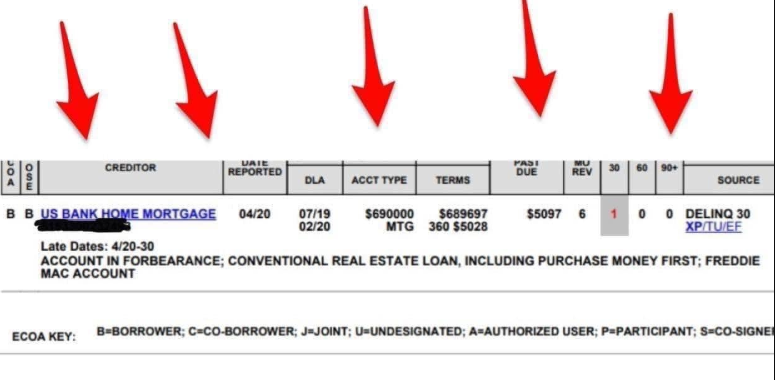

Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and 375000 for. Web So if you have one mortgage for 500000 on your main residence and another mortgage for 400000 on your vacation home you cant deduct the interest on. Web Mortgage servicers generally cannot ask for proof of hardship.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Web 1 day agoAffordability is hindered. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to.

You can ask for forbearance and tell your servicer that you are going through a financial hardship because of the. Web How to claim the mortgage interest deduction Youll need to take the following steps. It is primarily used in its most literal sense by.

Mortgage rates rise for fourth week in a row surpass 7. Lets say you paid 3000 in mortgage interest 1000 in insurance premiums and 3000 in utilities all indirect expenses plus 500 on a home. Web Most homeowners can deduct all of their mortgage interest.

Web Starting with the 2018 tax year only interest on mortgage values of up to 750000 are now deductible. Ask a Tax Expert for Info Now About How to Write-Off Mortgage Interest in a Private Chat. Web The limit is scheduled to last through the 2025 tax year unless Congress extends it.

Web A write-off is an accounting action that reduces the value of an asset while simultaneously debiting a liabilities account. Web Can you write off mortgage payments. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

Taxpayers can deduct the interest paid on first and second mortgages up to 1000000 in mortgage debt the limit is. Web If your adjusted gross income AGI is below 100000 50000 if married and filing separately you can deduct your mortgage insurance premiums in full.

Is Mortgage Industry Equipped To Implement Washington S Forbearance Plan American Banker

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

/cdn.vox-cdn.com/uploads/chorus_asset/file/23122906/1333880572.jpg)

Steelers Covid 19 Issues Continue With 2 More Players Added To The List Behind The Steel Curtain

How Forbearance Impacts Mortgage Brokers And Homeowners Aime Group

3tvuhadesnqhvm

Free 10 Loan Payoff Statement Samples In Pdf

Mortgage Interest Deduction How It Works In 2022 Wsj

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Nelson Star September 19 2014 By Black Press Media Group Issuu

The Coronavirus Cares Act Mortgage Forbearance Plan California Mortgage Broker

Burnaby Now December 15 2022 By Burnaby Now Issuu

Delta Optimist September 17 2020 By Delta Optimist Issuu

Privately Held Mortgages In Forbearance May Be Harder To Navigate

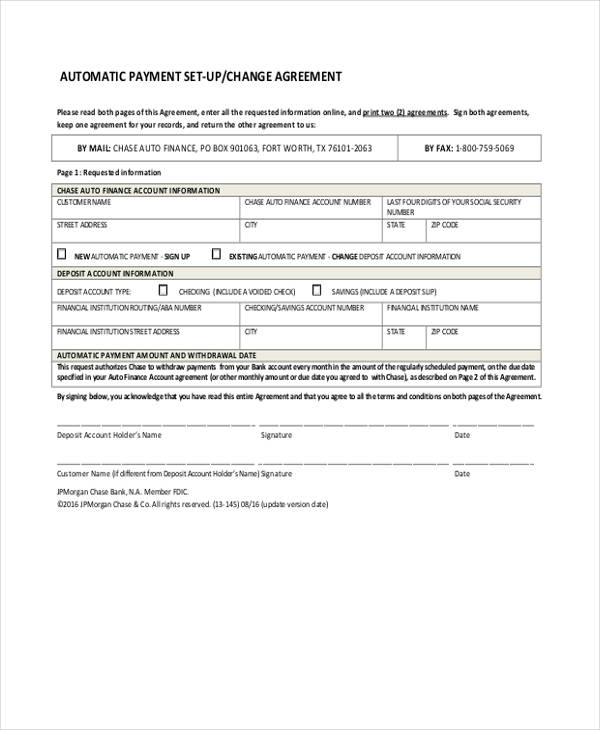

How To Make A Car Loan Agreement Form Templates

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

/cdn.vox-cdn.com/uploads/chorus_asset/file/22689676/usa_today_16335763.jpg)

New Crew Stadium To Celebrate Goals With Power Tools Sounder At Heart